- Joined

- Apr 2, 2005

- Messages

- 14,042

- Reaction score

- 2,042

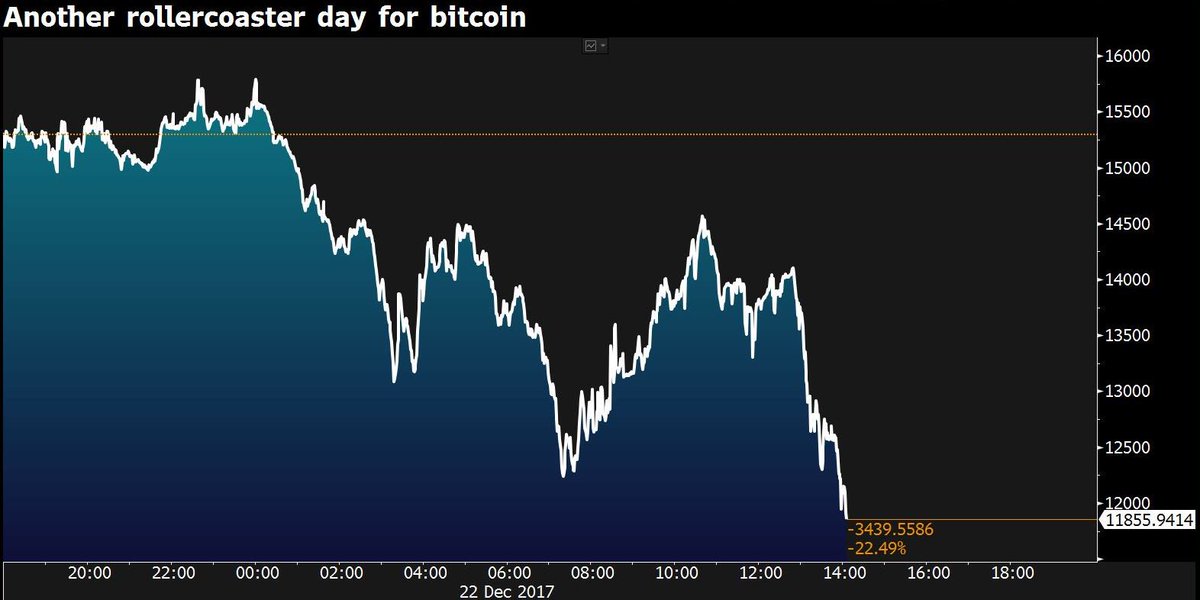

The sleeping giant that is Litecoin seems to be waking up. If you are into crypto at all, you may want to buy some Litecoin here. It is currently trading at $160. Litecoin has 4 times the max supply, so to have the same market cap it would be trading at $4,000. Parity with Bitcoin may not be realistic at this point, but half BTC's market cap should be. That's be $2,000 at current BTC price.

With Steam at least temporarily dropping Bitcoin due to high transaction fees, speculation is they will start to accept Litecoin which is faster, less volatile than Bitcoin, and transaction fees are in the pennies. If Steam starts to accept Litecoin, we will see $2,000 Litecoin nearly overnight.

-Edit-

Actually I am a little late. Part of the rally is due to the fact you can buy Steam refills with Litecoin already. I'll investigate tomorrow what refills mean. i suspect it's not directly in the Steam store?

With Steam at least temporarily dropping Bitcoin due to high transaction fees, speculation is they will start to accept Litecoin which is faster, less volatile than Bitcoin, and transaction fees are in the pennies. If Steam starts to accept Litecoin, we will see $2,000 Litecoin nearly overnight.

-Edit-

Actually I am a little late. Part of the rally is due to the fact you can buy Steam refills with Litecoin already. I'll investigate tomorrow what refills mean. i suspect it's not directly in the Steam store?