Tesla is the industry leader in the EV field. They benefit directly as more people switch to electric cars since they are the pioneer in that space.

Remember AltaVista or - to use a more recent example - Yahoo? How about MySpace? What about AOL?

Being an "industry leader" or a "pioneer" does not have any guaranteed intrinsic financial value. The often cited "first-mover advantage" does exist but it is actually less common than many business books make it sound like. Plus, it can and will eventually go away.

They also do energy storage and solar and are probably entering even more markets. Is there stock too high? Maybe, but I doubt it will ever go down to the amount I paid for it many many years ago.

Actually, their solar panel business is close to non-existent and they are still actively trying to figure out how to make it work. After all these years, they remain in a testing phase and continue to solicit feedback from roofing companies to figure out how they could scale up the business.

I like the general concept of "invisible" solar panels and have been following this for a while but Tesla appear to be really struggling with this. I suspect their initial cost estimates were overly aggressive and driving up sales would be highly unprofitable until they figure out how to lower manufacturing costs.

Is there stock too high? Maybe, but I doubt it will ever go down to the amount I paid for it many many years ago.

Maybe? Definitely.

Pick

any large highly successful company that you can think of and look up their market cap. Next, look up their annual revenue. Next, divide the market cap by their annual revenue.

Example 1: Apple's 2020 revenue was $274.515 billion. Their market cap hovers around $2.3 trillion. So, Apple's price-to-sales ratio is roughly

8.

Just a reminder, Apple is considered to be one of the most successful companies in the world. They managed to get to

1 billion active iPhone users this year.

Example 2: Amazon have been killing it over the past decade. Between 2010 and 2020, their stock price jump from around 100 USD to over 3,000 USD. There are over 310 active customer accounts and Amazon Web Services is the world's leading cloud services provide.

Amazon's price-to-sales ratio is roughly

4.

How about Tesla? Well, their price-to-sales ratio is

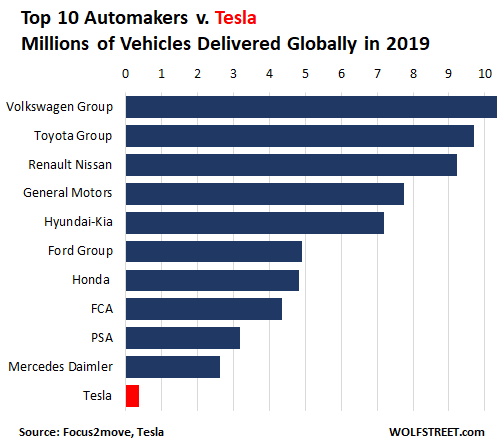

27.37, yet they have merely sold roughly 1.5 million cars over the course of 17 years.

Of course, knowing you are in a bubble does not mean you cannot still profit from assuming a stock might go even higher. However, you do not have to be Nostradamus to figure out that a downward correction of the Tesla stock is more or less inevitable. Taking at least some winnings and investing them in a different stock should be a sensible strategy.

Toyota made a big bet on Hydrogen cars and now that that's failing they want to be a leader in the EV space. They may already be too late to catch up to Tesla's R&D.

Have you heard of the Prius? Toyota has sold

15 million of these. Tesla only managed to pass the mark of 1 million sold cars some time last year.

As long as your daily commute is short enough, you can in fact drive a Prius all-electric - except you still have the option to use gasoline for long trips if you ever needed to, which does provide a lot of flexibility.

It would be a mistake to discount Toyota's historic contribution for the mainstream adoption of electric cars. I was driven around in a Prius in D.C. all the way back in 2007 when pretty much nobody knew Tesla existed.

As for hydrogen, I would not belittle their efforts just yet. Just because hydrogen might remain a niche in the passenger car space, there is very serious interest in hydrogen for industrial applications (moving containers at ports or in warehouses, etc). Japan's government continues to invest heavily into hydrogen research because, being an island state with few resources, they see strategic value in not being completely dependent on, say, lithium that has to be imported in large quantities from elsewhere.

When the Amiga was first demonstrated many mainstream computer publications and users dismissed it and were trying to debate and question the merits of computers having multitasking, hardware-accelerated graphics, stereo sound, more colors, compatibility with video standards. Hint they didn't think these features were necessary. If a manufacturer tried to release a machine without these features today it would be completely rejected by the market. I believe in six or seven years a car manufacturer releasing a new high-volume gas sedan will also be an absurd idea.

See above. The Amiga is proof that being a "pioneer" at some point does not guarantee success or even long-term survival. History is full of technical marvels that ultimately failed to gain traction.